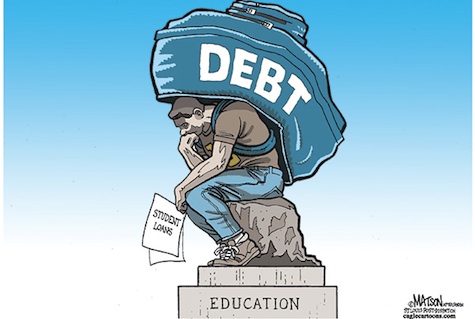

While many economists say student debt should be seen in a more favorable light, the rising loan bills nevertheless mean that many graduates will be paying them for a longer time.

“In the coming years, a lot of people will still be paying off their student loans when it’s time for their kids to go to college,” said Mark Kantrowitz, the publisher of FinAid.org and Fastweb.com, who has compiled the estimates of student debt, including federal and private loans.

Two-thirds of bachelor’s degree recipients graduated with debt in 2008, compared with less than half in 1993. Last year, graduates who took out loans left college with an average of $24,000 in debt. Default rates are rising, especially among those who attended for-profit colleges.

The mountain of debt is likely to grow more quickly with the coming round of budget-slashing. Pell grants for low-income students are expected to be cut and tuition at public universities will probably increase as states with pinched budgets cut back on the money they give to colleges.

Some education policy experts say the mounting debt has broad implications for the current generation of students.

“If you have a lot of people finishing or leaving school with a lot of debt, their choices may be very different than the generation before them,” said Lauren Asher, president of theInstitute for Student Access and Success. “Things like buying a home, starting a family, starting a business, saving for their own kids’ education may not be options for people who are paying off a lot of student debt.”

In some circles, student debt is known as the anti-dowry. As the transition from adolescence to adulthood is being delayed, with young people taking longer to marry, buy a home and have children, large student loans can slow the process further.

“There’s much more awareness about student borrowing than there was 10 years ago,” Ms. Asher said. “People either are in debt or know someone in debt.”